Reigniting Impossible Meat Appeal

Led a research and strategy sprint to recalibrate Impossible Foods’ brand perception. Synthesized consumer insights and store observations to craft a 10-year strategic roadmap.

ROLE

Desk, field & trend research

Creative strategy

Brand & consumer insights

TIMELINE

Mar - April 2022

Context

Impossible Foods is a pioneer in the plant-based meat industry, creating a burger that sizzles, browns, and even bleeds like real beef. The company experienced strong early growth but struggled with widespread adoption, with only ~5% of U.S. households purchasing its products in 2021. We aimed to address these adoption challenges and reposition the brand for sustainable, broader market appeal.

90% of Impossible’s customers are meat-eaters seeking eco-friendly, healthy alternatives

Research Approach

Our research spanned the full consumer journey, from in-store experiences to Impossible’s digital presence, to build a foundational understanding of the brand’s perception.

We conducted 50 in-depth interviews to capture insights from a wide range of consumers, segmented into four key groups:

Interviews

Each interview was one-on-one, exploring participants’ awareness of the brand, personal experiences with plant-based meats, impressions of Impossible Foods’ taste and healthfulness, and concerns. This segmentation revealed differences in product acceptance and impressions.

We visited multiple retail locations to observe how Impossible Foods products are presented in a real shopping context. I also spoke with several shoppers after they selected items from the meat aisle to understand their decision-making process.

Field Observations (Grocery Stores)

Observing which labels & signs caught shoppers’ attention and how clearly messages were communicated

PACKAGING ENGAGEMENT

Noting if Impossible products were in the meat aisle or plant-based section, and documenting nearby competitors

PRODUCT PLACEMENT

Understanding how consumers compared products, checked prices, and made purchase decisions

DECISION FACTORS

Lastly, we audited Impossible’s digital presence, including their website and social media pages. We examined how key topics were addressed, such as Impossible’s ingredients and technology (ex: clarifying the use of GMOs in the form of “heme” and why it’s safe) and the company’s sustainability mission.

Digital Channel Audit

Emerging Trends

We analyzed 30 signals of change to understand the market landscape and anticipate future shifts. Key trends include:

Key Findings

The neon blue branding makes the meat feel "techy," "manufactured," and "processed"

BRANDING CONCERNS

Impossible ground beef ($9-10/lb) is double the price of regular ground beef ($5/lb)

PRICING DISCREPENCES

Many meat-eaters don’t have ethical issues eating real meat, while vegetarians reject Impossible for tasting too much like meat

POOR PRODUCT-MARKET FIT

Impossible has 4x more sodium than regular beef, making up 16% of the daily recommended intake in one serving

HIGH SODIUM

Impossible explains GMO safety online, yet its packaging omits this info. Shoppers have no ingredient context at the point of sale

ONLINE TO SHELF EDUCATION GAP

Impossible is served primarily at fast-food chains, creating a disconnect with their health- and sustainability-focused consumers

FAST FOOD ASSOCIATION

Impossible’s futuristic and synthetic branding does not align with their buyers’ values of health and sustainability.

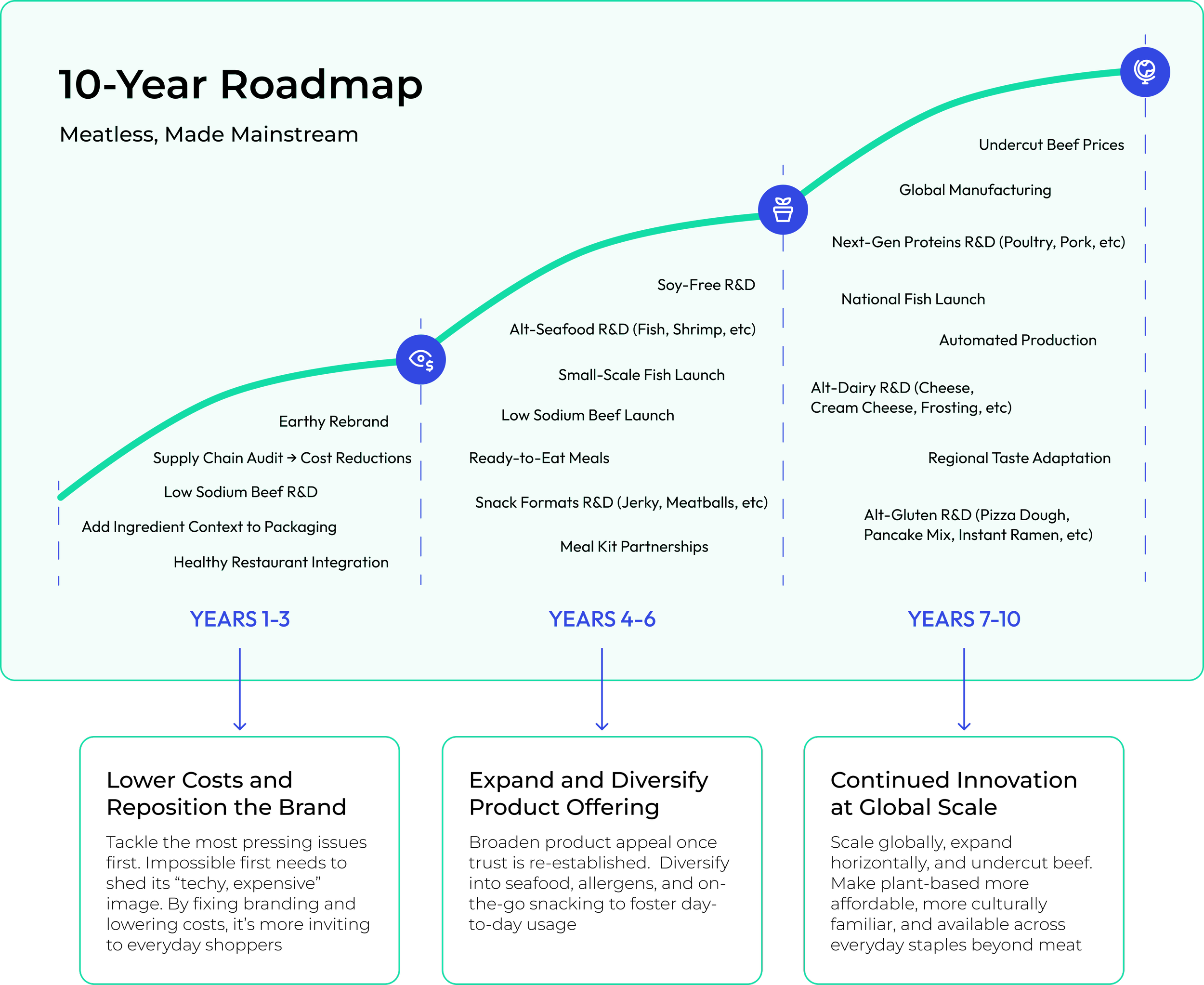

Proposed Roadmap

Taste Test

We obviously had to wrap up our research by taste-testing Impossible meats, both at home and from restaurants. They exceeded every expectation, with such a realistic flavor and texture that we forgot it was plant-based meat.

In Q1 2024, Impossible Foods rebranded with bold red packaging to better appeal to meat-eaters. Check out their new look at impossiblefoods.com

My Learnings

TRANSLATING FIELD OBSERVATIONS INTO PRACTICAL SOLUTIONS

Fieldwork in grocery aisles revealed barriers that desk research couldn’t capture, like sticker shock at the shelf and shoppers favoring Beyond’s natural brown packaging over Impossible’s neon blue. Observing consumers in action uncovered subtle, critical decision factors that informed more grounded, actionable recommendations.

BALANCING QUICK WINS WITH A LONG-TERM VISION

We introduced immediate packaging tweaks to ease confusion while also planning a broader brand overhaul to build trust. Handling urgent fixes alongside a strategic roadmap showed me how to prioritize near-term impact without losing sight of sustainable growth. This proved to be critical in fast-paced, evolving environments.

TAILORING COMMUNICATION FOR DIVERSE AUDIENCES

Interviews with meat-eaters, flexitarians, and vegetarians showed that different groups value distinct messaging. Recognizing these nuances enabled tailored communication that resonates with each audience, a practice that applies across any user-focused initiative.